Tags

Bargain, budget, cash back, expenses, freebies, Guide, how to, how to get, saving, tips, top cashback, university

Budgeting isn’t something most 18 year olds have had to do, the stability of a family home is a safety net for your finances, but moving to uni can be scary if you are worried about money too!

I start university this september (late… admittedly!) So I starting lurking on The Student Room to get a feel for the community. The number one worry I see is ‘I have no idea how I’m going to afford to live’, and seeing as hell, i’d probably be worried too if my husband wasn’t full-time employed, i thought i’d talk through some budgeting tips that we have used to get by the hard times, that apply to uni!

First up, we have a comprehensive guide to HOW to make a budget, and know your living costs. Below, i have some tips for making that money go further, just whizz in the numbers that apply to you, and off we go!

Know Your Limit

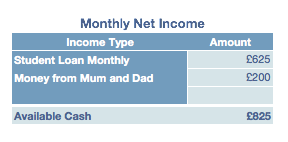

The first bit goes like this, add your total loans and grants – online, the majority seem to be getting around £7500.

Divide this by the full 12 months, as there is a larger gap between your April and September Student Loan than any other payments, this is because generally you will go and get a summer job, as you aren’t in uni for the summer, but bear with me, if things don’t go to plan, you’ll be glad you did it this way.

Now add any money you will get from your parents, judging by what I’ve read online, £50 a week (£2400 a year) is the average.

£7500 Student Loan and Grants, + £2400 from parents.

£9900 a Year, £825 a month.

Prioritise your expenses.

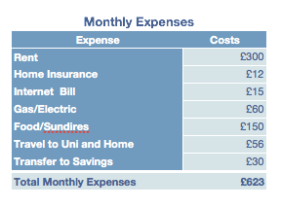

Living in student halls is more expensive than renting a room (sometimes £100+ a week?) but that covers your internet, gas and electric, water etc. so you don’t have those bills to worry about. My calculations include gas, electric, water, internet etc. This is something to think about once you’re out of halls.

Don’t forget to account for things like Home Insurance (student houses DO get broken into, and are often targeted specifically, get student home insurance, it’s fairly cheap and will make sure you get a Laptop and Phone if they’re stolen.) and things like Pens, Notepads, and any equipment you need for your course.

Don’t forget to account for things like Home Insurance (student houses DO get broken into, and are often targeted specifically, get student home insurance, it’s fairly cheap and will make sure you get a Laptop and Phone if they’re stolen.) and things like Pens, Notepads, and any equipment you need for your course.

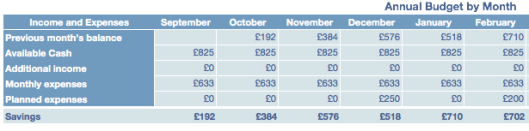

Add all your monthly expenses up, accounting for bus passes, travel home to see family, and food. As long as this is less than your income, or line of credit, perfect. On my calculations, this leaves £192 spare income a month.

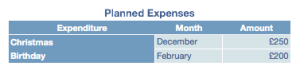

Do you have any other expenses? I’ve put Christmas and Birthday on, as these are times you might want to spend a little more. These are under ‘Planned Expenses‘.You can also add ‘Additional Income’ such as Bursaries, i haven’t added them to my budget because not everyone gets them.

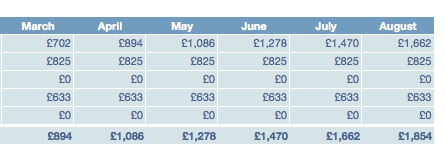

Put this all into a table (I use Apple’s – Numbers, it does all the math for me!) The total ‘Savings’ at the end in August is basically the total spare expenditure you’ll have for the year, assuming you get no summer work or extra money. so £1854 after Expenses, Christmas, And birthday money is £154.50 a month.

Extra Tips

Don’t Blow The Budget

Only take out with you what you can afford to spend. On a night out? Budgeted £30? Only take out £30.

Go Bargain Crazy

You know at around 7 o’clock they reduce all the food thats at the end of the display date to ridiculously cheap? Don’t be afraid to buy it, freeze it, or eat it that night. To be honest, its generally good for another day or two, just make sure to smell it and check it looks ok. We get whole extra large cooked chickens for £3, and can make two or three days of Chicken Pie with them, and a £1 roll of pastry and 50p of veg. (Bread £20p a loaf? Freeze it!!)

Get a Jar

It doesn’t have to be one of these, these i got on Ebay for a few pounds (they’re about £10+ in shops) at the end of every week i empty all of my change into the jar, pound coins into the blue ‘Holiday Fund’ and silver into the other one. I pulled all my money out with tweezers (I didn’t want to smash them…) before our holiday this year, and it was over £400. Our copper change goes into a emptied out Yankee Candle Jar. Crack it open at christmas, for a weekend away, or whenever you get a bit skint! I don’t tend to notice the money gone, a few £££’s here and there.

Good Friends Split The Bill

Does anyone have a Costco card? You can save a fortune buying in bulk, admittedly, you may have to buy a lot to begin with, but if you want cases of energy drink for exam time, Big packs of danish pastry, cereal, tea bags, meat, go as a team. Shop as a household, and split it all when you get home. When we’ve been more hard up (when my husband was in uni and student loans didn’t pay him…) we’ve had a freezer full of Costco chicken and danish pastries. Pick up a leaflet on your way in, they often have extra offers in store, great for the pricier items like Washing Liquid and Fabric Softener. If you haven’t got one, ask everyone you know. If you know someone with an account, its only £12 to be added too the account.

Go Cash Back Crazy.

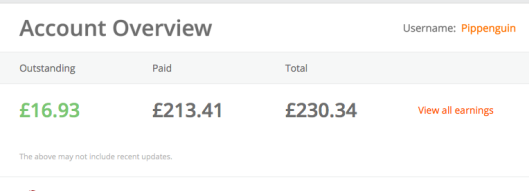

I use an app called Top Cashback on my phone – basically if I’m buying anything online i just search the merchant, visit the page via the app and I get cash back in a few weeks time, if you think its a waste of time, below are my stats since joining last year.

The best student bank accounts do cash back too, only in certain places though (a lot less than top cash back) but I’ve still managed to get £11.60 from Natwest. Make sure you’re signed up!

I hope that this helps someone!

Do you have any more tips? How do you keep your spending in check?

My little brother leaves for Liverpool in like 2 weeks, he’s getting this emailed to him immediately!! Lol…Thanks for the post! :~) x

http://vixensfashion.blogspot.co.uk/

Oh how I miss that exciting moment of seeing that my student loan had come through. That night was always one of the best nights out of the year 🙂